The First 3-in-1 Business Credit Card to Offer 0% Interest for 60 Days¹ on Every Eligible Purchase.

Experience best-in-class benefits, better rewards, and 60 days of no interest.¹ All in one unbeatable card.

Flex Between Interest-Free Float and Exclusive Rewards.

Keep Cash on Hand for up to 2.8x4 Longer Than Traditional Cards — at 0% Interest.

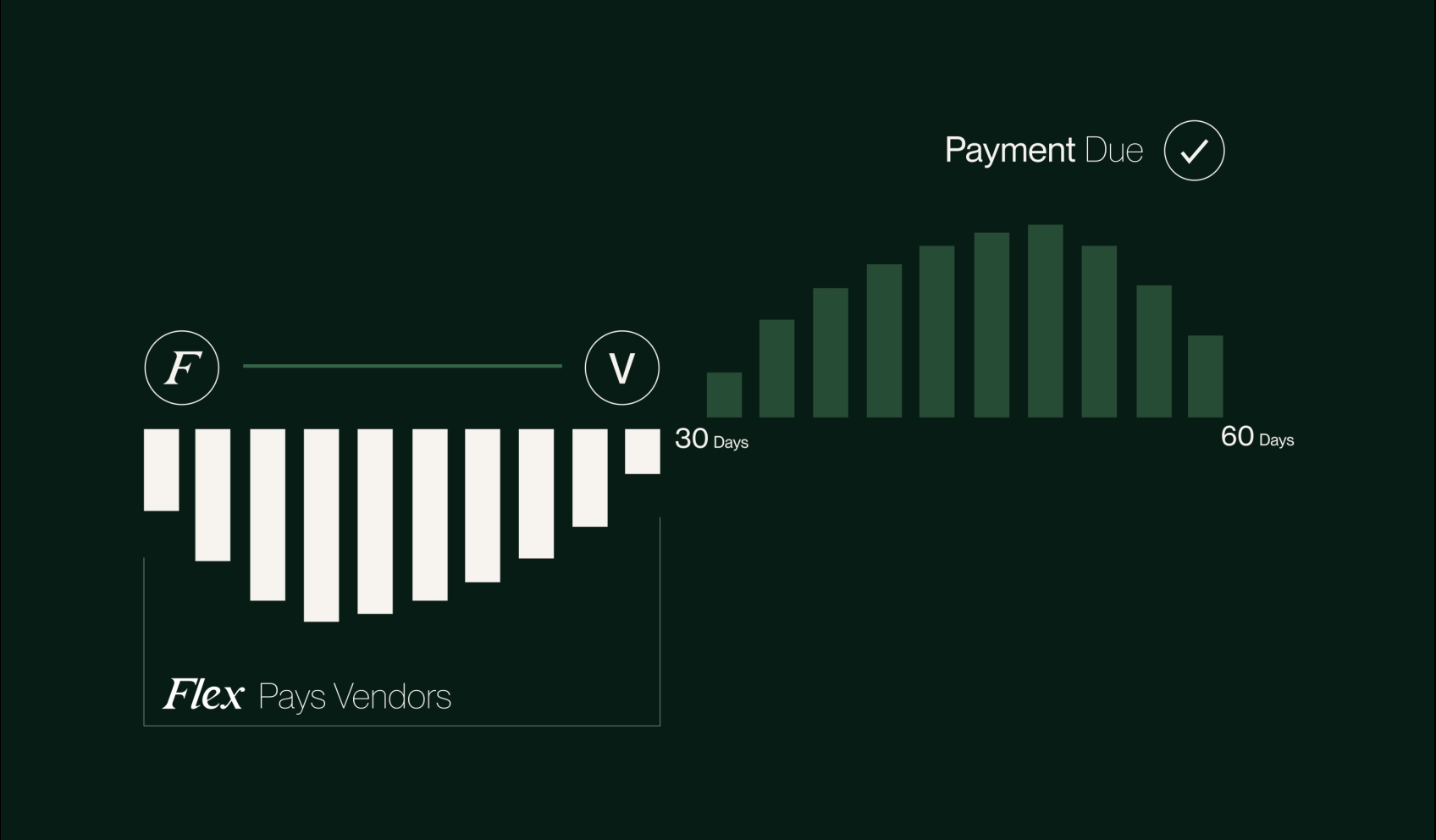

Focus on growth, not interest fees. Flex cardholders enjoy a unique interest-free period of 60 days on every eligible purchase. Experience more flexible borrowing and turn cash flow into a growth lever.

Say goodbye to rigid, one-size-fits-all credit limits. At Flex, we take the time to understand your business, evaluating its unique needs, cash flow, and transaction history. Using advanced analytics, we provide a credit limit explicitly tailored to your business, giving you the flexibility to drive growth and achieve your goals.

Pay your vendors quickly while giving yourself up to 75 days of float.¹ With your Flex credit card, you can pay all your bills and vendors—even those that don’t typically accept credit cards.³ Your bills are paid via same-day ACH or wire transfers on your behalf, while you benefit from interest-free borrowing, keeping more cash on hand. Plus, earn valuable rewards on every transaction.

Earn Up to 1.75%

Unlimited Cashback.²

Earn up to 1.75% Cashback on your business expenses when you pay your balance early. Prefer more flexibility? Take advantage of float and earn 1%-1.5% Cashback. The choice is yours — opt for rewards or extended payment terms that work best for your business.

When you make recurring, early repayments, you accumulate more Cashback with no caps or restrictions. Then, redeem rewards points earned for cash back, gift cards, airlines, hotels, or statement credits.

Unlike other business cards, Flex offers unlimited earning potential. That means infinite cashback redemption — no caps, no limits, just rewards that grow with your business.

Turn your points into cash with ease. Redeem all your points for cashback at the click of a button — earning up to 1.5% back on your business spending. Simple, seamless, and rewarding.

Experience World-Class Travel & Lifestyle Rewards.⁺

Automated early payments to maximize rewards. Earn up to 1.75x points on your business expenses when you pay your balance daily. Then redeem points for cash back, gift cards, or statement credits. Prefer more flexibility? Take advantage of float and still earn 1x-1.5x points. You choose.

From five-star stays to first-class flights, Flex points unlock luxury travel. Redeem Flex points at multiple airlines, hotels, and major brands worldwide. Go Further with Flex Travel and enjoy competitive rates with upgrades and perks*.

Enjoy worldwide acceptance with no foreign transaction fees. Experience international purchases that are convenient and fee-free.

Redeem points for the rewards that matter most to you. Transfer points to airlines and hotels to unlock luxury travel experiences or turn points into cashback, gift cards, or statement credits.

As a Visa Infinite cardholder, enjoy a wide range of benefits such as 24/7 concierge service, international travel and purchase protections, car rental discounts, and VIP status within the Visa Luxury Hotel Collection.

Flex Credit Card Perks & Benefits.⁺

Simplify Financial Management.

Scale Without Limits.

.png)